Highlighted Opinions

Why not taking a look through some different views of global trade conjunctures?

Free Trade Is Not the Enemy

Nafta’s shadow hangs over this deal, but the truth is that both its upside and its downside are smaller than anyone likes to admit. Now we have a chance to guide a huge section of the world’s economy to reflect our own high standards for commerce. Why would we deny the president the opportunity to seize this moment?

The world is de-globalizing. Trump set the example.

This phase of deglobalization is being steered from the top. The world’s leading nations are, as always, the agenda setters. The example of China, which has shielded some of its markets and still grown rapidly, has made a deep impression on much of the world. Probably deeper still is the example of the planet’s greatest champion of liberty and openness, the United States, which now has a president who calls for managed trade, more limited immigration and protectionist measures.

Collaboration with China is the way forward

Competitiveness and conflict are more in evidence than the principal and prospect of a future seen as “better together”. We are left in a position to continue our endeavors at local and regional levels to work across borders and barriers since there are no longer indications that a spirit of working together with common purpose is in the minds of leaders.

Latest News

Coronavirus: How are other economies dealing with the downturn?

Details of the responses vary, although there are some common objectives. Many countries have given businesses financial incentives not to make workers redundant.

There are tax breaks and loans for firms to help them contend with a collapse in revenue, and there are measures to help the most vulnerable people. Many countries have also set aside extra funds to help health systems cope with the burden imposed by the virus.

“Trade has ever been the extinguisher of war, the eradicator of prejudice, the diffuser of knowledge.”

Henry George

Eurozone recession ‘will be deeper than forecast’

The eurozone economy will sink deeper into recession than previously thought due to the effects of the pandemic, the European Commission (EC) has said.

The bloc will contract a record 8.7% this year before growing 6.1% in 2021. It compares with the EC’s May forecast of a 7.7% slump and 6.3% growth.

France, Italy and Spain will struggle the most, the EC said.

Its revised forecast comes amid concerns about the US economy after a surge in infections.

This has prompted several states to delay or reverse lifting restrictions.

Commission Valdis Dombrovskis said in a statement: “The economic impact of the lockdown is more severe than we initially expected.

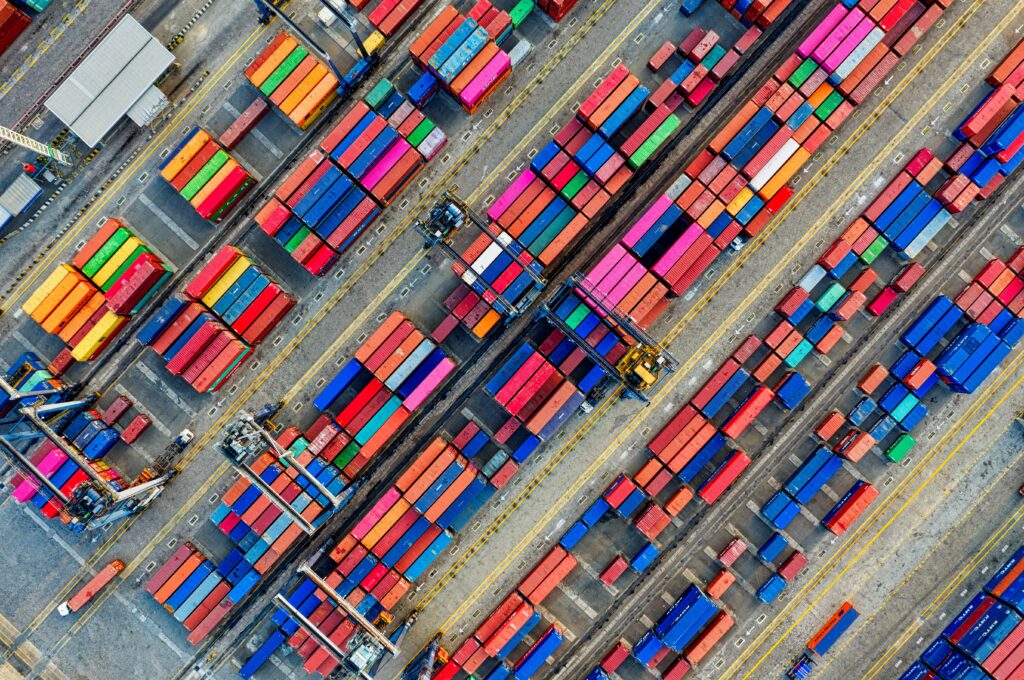

All our eggs in one basket: COVID-19 demonstrates the vulnerability of global supply chains

The COVID-19 pandemic and resulting economic upheaval has clearly exposed the vulnerability of global supply chains and highlights the dangers of relying on the manufacturing facilities of a single country, China.

When you hear the word “coronavirus” what comes to mind? Empty store shelves, daily news briefings about flattening the curve, or perhaps cost-cutting measures at your company? If you are a trade professional, what should come to mind is how coronavirus is disrupting global supply chains.

The escalation of the COVID-19 pandemic has increasingly exposed the vulnerability of our supply chains due to their reliance on a single country’s manufacturing facilities. China largely was seen — and still is seen — as a country made up of a low-cost workforce with mature manufacturing facilities, both helping to reduce production costs and increase profit margins for companies that produce and source goods there. Given the number of companies that source products in China, the effect of COVID-19 on supply chains is profound.

Companies are now acknowledging that reliance on any single country is unwise, sparking discussions about “western companies’ reliance on China,” according to The Financial Times. Companies in all industries — from automotive to electronics to apparel and footwear — are reeling from the effects the pandemic has had on manufacturing in China. Larry Fink, CEO of BlackRock told The Financial Times, “I do believe there’s going to be a review of supply chains at every company in the world.”

0 Comments